If you own a business that relies on a Texas commercial truck to earn income and can’t find insurance then you have a real problem. Business Owners may call (833) 604-1348 for help.

Submit your business information for quick help and see if we can find you affordable Texas Commercial Truck auto liability, cargo coverage, physical damage, general liability and other necessary coverage’s.

We have specialized help for Texas startups or new venture businesses that need to find insurance.

Typical Texas Commercial Truck and business use vehicle insurance coverage’s includes:

Bodily Injury Liability – Coverage for damages that involve bodily injury to others for which you become responsible under law.

Property Damage Liability – Coverage for damage to property of others for which you become responsible under law.

Medical Payments – Coverage for reasonable and necessary medical expenses and funeral services for those who are accidentally injured while in your automobile or while getting into or out of your automobile.

Personal Injury Protection – Coverage for medical, hospital, rehabilitation, loss of wages or loss of services costs resulting from injury to you or any resident family member. In case of death to the insured or a resident family member, death benefits and survivor benefits, if applicable, will be provided.

Other coverage that may be obtained include:

Comprehensive – Protection for the loss of or damage to your vehicle and its equipment from all causes except collision, subject to the deductible on the policy.

Collision – Protection for the collision damage to your automobile and its equipment, subject to the deductible on the policy.

Uninsured Motorist – Coverage allows you to recover bodily injury damages due to an accident where the other party does not have insurance, and is found legally liable.

Underinsured Motorist – Coverage allows you to recover bodily injury damages due to an accident where the other party is found legally liable and does not have adequate liability limits.

Additional Expense – Coverage for necessary additional expenses incurred as a result of a loss for which you are protected under comprehensive or collision coverage. These expenses include rental cars, food, lodging and other incidental expenses.

Hired Auto Liability Coverage – Covers liability for automobiles hired under contract on behalf of or loaned to the named insured.

Hired Auto Physical Damage – Coverage for an automobile of any type, hired, borrowed or leased on a short term basis for use in the insured’s business.

Employer’s Non-Ownership Liability – Coverage for a private-passenger automobile used in the business of the named insured by any person, or the occasional and infrequent use of a commercial automobile in the business by any of your employees.

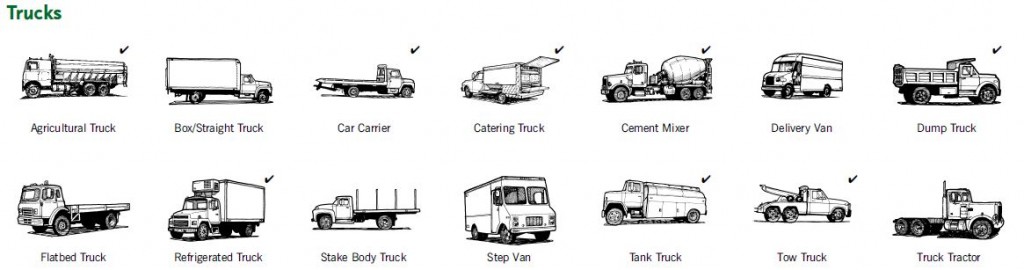

Possible business types coverage’s available, but this does not list all of them, just the most requested. If you have questions call for help now (855) 910-9321 or (833) 604-1348 .

Big Rig and Box Truck – Trucking For Hire: – Car Carriers – Fuel Oil Haulers Gasoline, Diesel & Airplane Fuel Haulers -Ag Haulers (including livestock) – LPG, Butane & Propane Haulers Bulk or Bottled – Dumping Operations – Contractors – Tow Trucks – Caterers – Cement Mixers – Concrete Pumper Trucks – Couriers – Custom Harvesters • Farm to Market Trucking – Farmers – Food Delivery – Grain Haulers – House Movers – Lawn & Tree Service – Logging – Mobile Concessions – Mobile Equipment – Mobile Home Toters – Moving Operations – Pulpwood Haulers – Salvage Haulers – Specialized Delivery • Snow Plows – Truckers Contingent Liability (Bobtail or Deadhead) – Waste Oil Haulers – Wholesalers & Manufacturers – Truck Fleet Insurance.

Texas Commercial Truck and other vehicle classifications

•Light Truck – Trucks with a Gross Vehicle Weight (GVW) of 10,000 pounds

or less

• Medium Truck – GVW between 10,001 – 20,000 pounds

• Heavy Truck – GVW between 20,001 – 45,000 pounds

• Extra Heavy Truck – GVW 45,000 pounds or more

• Truck Tractor – A motor vehicle for carrying commodities or material and

equipped with a fifth wheel coupling device for semi trailers.

• Heavy Truck Tractors – GVW 45,000 pounds or less

• Extra Heavy Truck Tractor – GVW 45,001or more

• Semi Trailer – A trailer equipped with a fifty wheel coupling device for use

with a truck tractor, with load capacity of over 2,000

• Trailer – Any type trailer other than semi trailer with load limit over 2,000

pounds

• Service or utility trailer – Trailer including semi trailer with load capacity of

2,000 pounds or less

Personal Auto Quotes Life Insurance Quotes Home Insurance Quotes Health Insurance Quotes